Looking to dive into Real Estate Investment in Lagos but unsure where to start? You’re not alone. The good news is, you’re exactly where you need to be! Whether you’re a first-time investor or looking to scale your property portfolio, Lagos is bursting with golden opportunities, from Lekki to Ikoyi and everywhere in between.

In this guide, we’ll explore 10 expert-backed strategies that work, not just in theory, but right here in the ever-evolving Lagos property market. From spotting underpriced gems to understanding rental income trends, we’re diving deep.

1. Start small, but start smart

Don’t wait until you can afford a mansion in Banana Island or Eko Atlantic; you fit wait taya. Buy land in developing areas like Epe or Ibeju-Lekki. These places are growing fast, and your property value will likely increase in no time!

2. Do your homework

Before you pay for any land or house, make sure it’s legit. Confirm land titles (hello, Lagos scams!) and check the zoning. This will save you from “had I known.” Don’t let them whine you in this Lagos o.

3. Think location, always

Where your property is matters more than how fancy it looks. Places close to schools, airports, transport, and markets usually give better rental income (whether short-let, commercial, or residential rental) and grow in property value.

4. Diversify your portfolio

Don’t put all your eggs in one basket—or in one property. Try owning land, short lets, or even co-owning a block of flats with others. This spreads your risk.

5. Use other people’s money (legally!)

Yes, you heard that right. With smart financing and mortgage options, you can get into Real Estate Investment without paying everything upfront. Just make sure your future income can handle the payback. Do your homework properly if you want to do this. Don’t carry what you cannot handle.

6. Look at rental income potential

If you’re buying to rent out, ask yourself, will people want to live here? A place with steady demand can give you rental income every month. That’s like a salary from your house! If your intention is buying to rent out and you don’t see why people should rent an apartment in that location, or the rent value is not giving, then it is not a good investment.

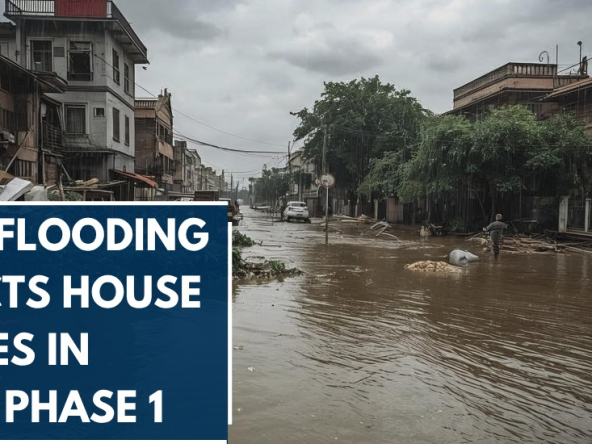

7. Renovate with purpose

Don’t just slap paint on the wall. Fix what matters—plumbing, kitchen, light. Upgrades that make tenants happy will increase your property value and make you more money. If there is a flooding issue, fix it. The worst that will happen is that you will increase the rent. In fact, while you do renovations like this, your tenants have already prepared their minds to pay higher because they are getting value for their money.

8. Network with other investors

Join real estate forums, WhatsApp groups, or even attend property events. Talking to others can teach you what’s working and what to avoid in Real Estate Investment.

9. Hire experts when needed

Don’t be shy to ask for help. Agents, lawyers, surveyors—they exist for a reason. A small fee now can save you millions later.

10. Keep learning

The more you know, the more you grow. Trends change, rules change. Stay updated.

Let’s Wrap This Up

Whew! We’ve gone through quite a journey, haven’t we?

Real estate can sound like big grammar and stress, but when you break it down, it’s actually pretty simple. Just like jollof rice, once you know the ingredients and how to mix them, you’re golden.

So, before you forget everything and let this juicy gist pass you by, here’s a quick summary of the big ideas:

- Start small, think big – You don’t need a billionaire’s wallet to start investing.

- Do your checks – Always confirm land documents and titles.

- Location is king – Buy where growth is happening.

- Don’t put all your money in one place – Mix it up!

- Let your house pay you – Think of rental income as pocket money.

- Fix the right things – Not everything needs a chandelier.

- Connect with people – They know what you don’t.

- Ask for help – Even big men have advisors.

- Keep learning – Lagos real estate waits for no one.

- Use other people’s money – You can you mortgage loans.

Now here’s the real gist: all of this is just a small piece of the puzzle. If you’re serious about investing smartly, you need to understand how to calculate what your property is really worth.

That’s where our special resource on Top 6 Property Valuation Methods for Smart Investors(Internal link to this article) comes in. It breaks everything down in a way that even your younger cousin could understand. This is the part most people skip… and that’s why most people lose money.

But not you. You’re smarter than that. You’ve read this far because you know your future deserves better.

So here’s your final, golden step:

👉 Contact Hanuel Homes for a free guide Seriously—don’t dull. Imagine doing everything right, but still missing out because you didn’t take expert help. What is the worst that could happen? That guide could be the one thing that helps you make millions instead of mistakes.